The Budget connection: ‘New generation entered trading-investment activities… boon for broking business’

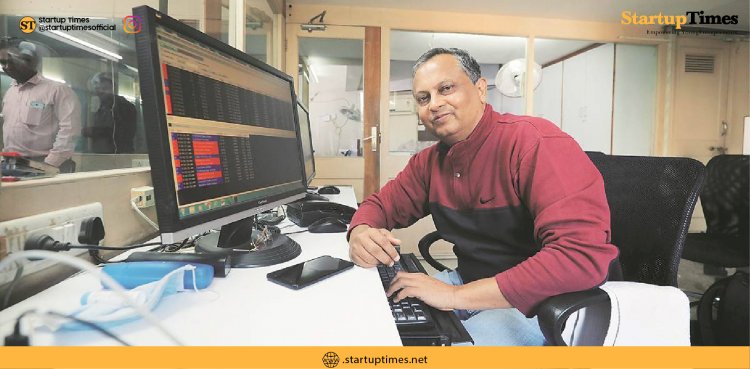

Saurin Shah (58), the CEO at his help financier firm, kept on working from the workplace in Ahmedabad during the lockdown just as post-lockdown months. The unanticipated conditions required a recalibration of his plan of action, yet he stays idealistic.

All organizations were influenced by the Covid-19 pandemic and the broking business was no exemption, Shah says. "However, when we entered the second quarter of the monetary year 2020-21, there was an adjustment in the fundamental culture, office activities were upset. Another age entered exchanging cum-venture exercises for a huge scope… which demonstrated a help for the broking industry.

Shah's firm, Saurin Financial Services Pvt Ltd, has 14-15 workers. "There was a compensation cut no matter how you look at it, yet this was recovered from the second from last quarter. Branch activities were reduced with innovation and another method of working together. These were the significant effects (of the pandemic)," he says.

"Four of us were working from an office. Driving was not an issue as we had SEBI consent to work. A few staff members need to straightforwardly manage customers, and the back office (who needed to come to the office) arranges the tasks. Our back-office tasks have been generally confined, particularly since banking activities can be executed on the web and are generally mechanized," Shah clarified.

The Budget Connection

The strong changes in banking and protection area, and a general consumption push that is required to give a fillip to development, will spike the securities exchanges. The Sensex hopped 5 per cent on Budget day, establishing pace for the year ahead.

Shah's firm, Saurin Financial Services Pvt Ltd, has 14-15 representatives. "There was a compensation cut in all cases, however, this was recovered from the second from last quarter. Branch tasks were shortened with innovation and another method of working together. These were the significant effects (of the pandemic)," he says.

"Four of us were working from the office. Driving was not an issue as we had SEBI authorization to work. A few staff members need to straightforwardly manage customers, and the back office (who needed to come to the office) organizes the activities. Our back-office activities have been generally confined, particularly since banking tasks can be executed on the web and are for the most part computerized," Shah clarified.

While he and his family were not contaminated by COVID-19, an office worker was. "He was hospitalized, and isolated for three weeks after release. He was telecommuting, and in this manner continued activities from office," he adds.

Shah's customer base is generally situated in and around Ahmedabad. Another age of financial backers has taken to on the web and digitized stages, including rebate financier alternatives, for example, Zerodha, and in the background of COVID-19, administration business firms, for example, Shah's have needed to rebuild broking expenses, which had in any case been serious, says Shah.

How they worked saw a total change, Shah says. "Zerodha, ICICI Securities, JM Financial were offering internet broking organizations. So the customer straightforwardly moved toward them. The new age is going to innovation-driven organizations. Broking business has been separated into two sections — one zeroing in on internet broking business, and second, the conventional broking houses which have developed into an assistance situated broking business, giving modified plans dependent on monetary prerequisites of the customer."